The history of taxation in the United States is an important one. Since we're not into the macabre, let's talk about taxes. The old saying goes nothing in life is certain except death and taxes. Marginal Versus Effective Tax Rates: How Much Do You Really Pay?

From the select box you can choose between HELOCs and home equity loans of a 5, 10, 15, 20 or 30 year duration. Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. These changes, as well as any other future guidance related to the 2023 tax year, will be available on Treasury’s website at Extra Funds to Cover Your Tax Obligations? Homeowners: Leverage Your Home Equity Today

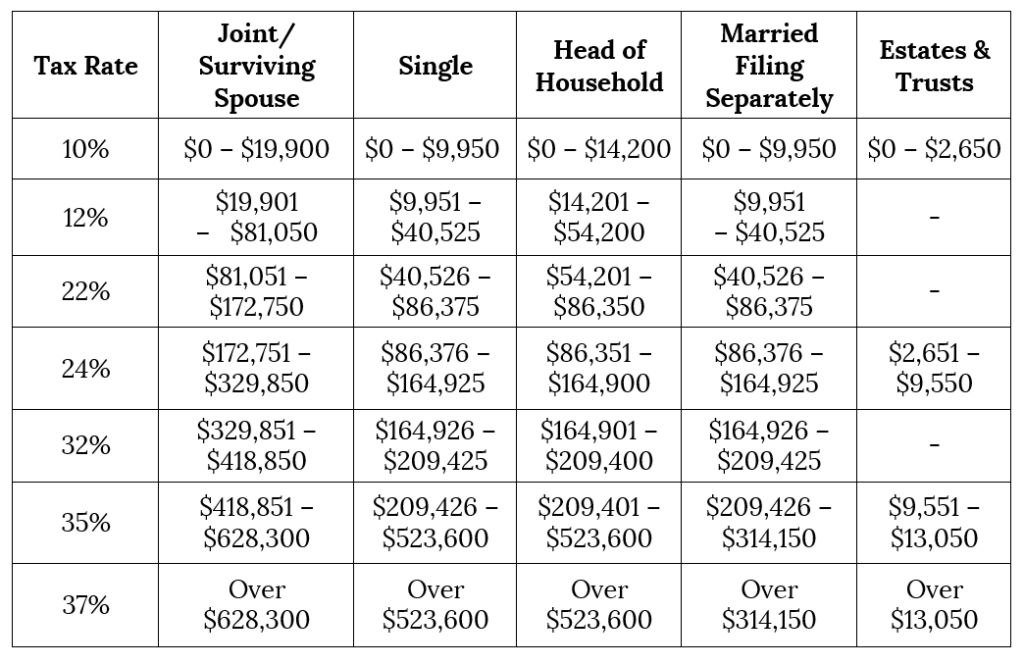

#2023 federal tax brackets update#

Treasury will update forms, instructions, and guidance as necessary to reflect the change to the annual income tax rate for the 2023 tax year.

Individuals and fiduciaries with questions about the effect of the rate change on the amount of tax being withheld from their income should contact their employer or administrator directly. Treasury’s withholding rate tables for the 2023 tax year will not be updated to accommodate the revised rate. This revised rate is an annual tax rate that is effective as of January 1, 2023. Thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. Based on the formula prescribed by Section 51(1)(c), the reduction to the current tax rate is equal to 0.20 percentage points (0.20%). That determination is required to be made jointly by the State Treasurer, the Director of the Senate Fiscal Agency, and the Director of the House Fiscal Agency based on financial data from the Annual Comprehensive Financial Report (ACFR).īased on recently finalized data from the ACFR for the fiscal year that ended September 30, 2022, it has been determined the conditions requiring a reduction to the current tax rate have been met. However, for each tax year beginning on and after January 1, 2023, that rate may be subject to a formulary reduction as provided by Section 51(1)(c) if there is a determination that the percentage increase in general fund revenue from the immediately preceding state fiscal year exceeded the inflation rate for the same period.

Individuals and fiduciaries subject to tax under Part 1 of the Income Tax Act, MCL 206.1 et seq., are generally subject to tax at a 4.25% tax rate under Section 51 of the Income Tax Act, MCL 206.51. Notice to Taxpayers Regarding Income Tax Deduction for Income Attributed to Cancellation

#2023 federal tax brackets registration#

Notice FTE Tax Payments Delayed Due to MTO Registration Will Be Treated as Timely for TPs REMINDER NOTICE FTE TAX PAYMENTS DUE BY MARCH 15 2022 Tax Rate Calculation on Gross Premiums Attributable to Qualified Health Plans for Tax Year 2022 Student Loan Forgiveness Not Subject to Income Tax in Michigan Notice Regarding the MI Catastrophic Claims Association Surplus For Insurers Notice Regarding the Implementation of 2022 Public Act 148 Notice of Tax Rate Calculation on Gross Premiums 2021

Notice to Taxpayers Regarding Public Act 207 of 2022 Notice Regarding Amendment to Michigan Beverage Container Law Revisions to Michigan Sales and Use Tax Rules Notice to Taxpayers Regarding IRS Form 1098 F Notice Regarding Industrial Process Exemption for Aggregates Notice Flow-Through Entity Tax Rate Reduced for Tax Years Beginning in 2023 Changes in the Taxability of Delivery and Installation Charges for SU

0 kommentar(er)

0 kommentar(er)